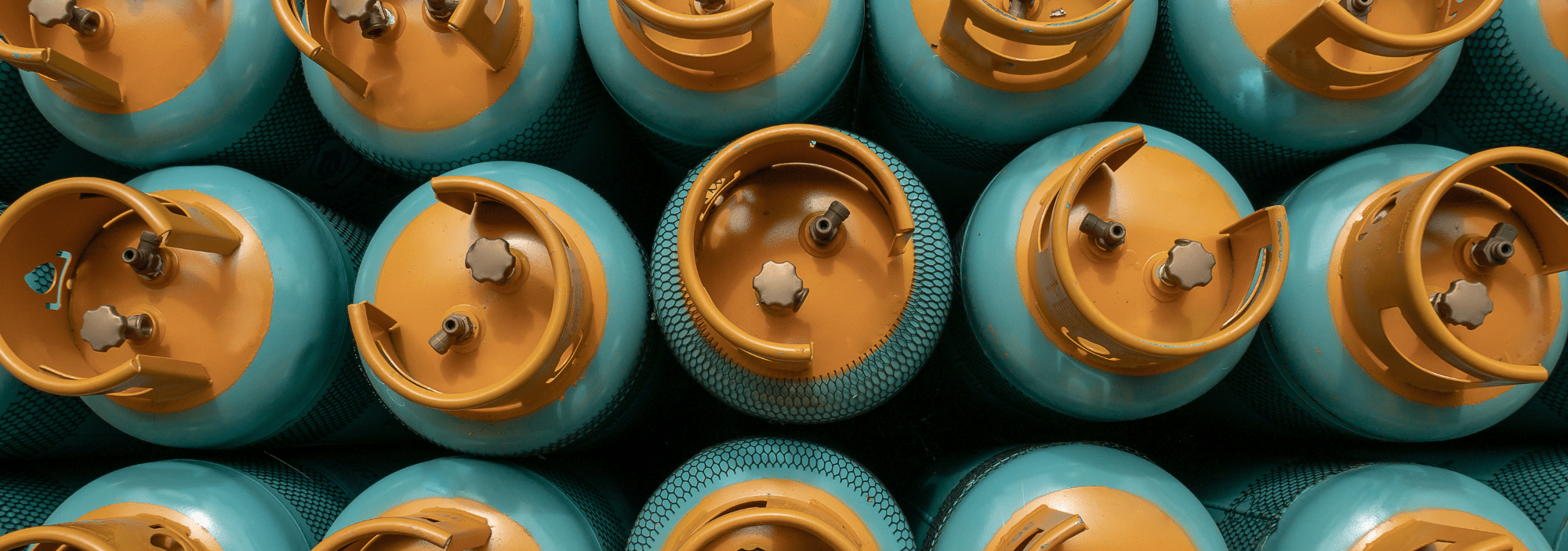

Green Gas Levy Explained

In a further attempt to help the UK meet its environmental and net zero goals the government has introduced a new scheme to encourage the deployment of ‘Green Gas’ I.E. Biomethane produced by anaerobic digestion (AD).

The Green Gas Levy (GGL) will come into effect this year, to help fund the Green Gas Support Scheme (GGSS).

What is Anaerobic Digestion?

Anaerobic Digestion (AD) is the process of turning organic matter, such as food, or animal waste, into usable biogas and fertiliser. This is achieved by sealing the waste in a tank (an anaerobic digester) with all oxygen removed – Green Gas is then released over time and can be injected into the National Grid.

What is the Green Gas Support Scheme?

Following the future support for low carbon heat consultation, carried out between April 2020 and August 2021, the Green Gas Support Scheme (GGSS) is expected to be launched in Autumn 2021. The scheme’s aim is to increase the proportion of Green Gas on the grid by supporting the anaerobic digestion industry which produces biomethane.

During the consultation, the following requirements were outlined:

- Encouraging continued deployment of AD biomethane plants in order to increase the proportion of green gas in the gas grid

- Ensuring value for money

- Minimising a market hiatus for the biomethane industry

What is the Green Gas Levy?

The Green Gas Levy (GGL) will be launched to help financially support the Green Gas Support Scheme. Currently, the majority of gas on the UK network is ‘brown’ and this figure needs to be reduced dramatically to help the government meet its net zero targets.

The new levy will incentivise the production of green gas and boost the anaerobic digestion sector. Under the GGL, producers will receive a payment for each unit of green gas they produce that is then injected into the grid.

Who will be impacted by the Green Gas Levy?

The GGL will impact all end users of the UK gas network.

Presently, end users are subject to non-Commodity costs which include costs such as Renewable Obligation and Use of System charges (read our ultimate guide to non commodity costs here). It is expected that the Green Gas Levy would be included in such charges.

When will the Green Gas Levy come into effect?

It has now been confirmed that the Green Gas Levy will come into effect in October 2021. For suppliers, the first levy payment will be taken during the first quarter of the financial year 2022/23, excluding those which produce at least 95% of green gas already.

These costs will then be passed on to end users, dependent on their supply. The exact figures are still under consultation at the time of writing, however, a flat charge ranging between £2, £20 and £220 per meter, per year has been suggested.

This rate could then be switched to a volume-based charge once the levy is fully established, although there are concerns that this charging mechanism could be complicated. Future rates will be dependent on the amount of biomethane generators which enter the market under the GGSS.

For more information regarding the Green Gas Levy and non-commodity costs get in touch with your relationship manager or contact us at bepositive@zenergi.co.uk.