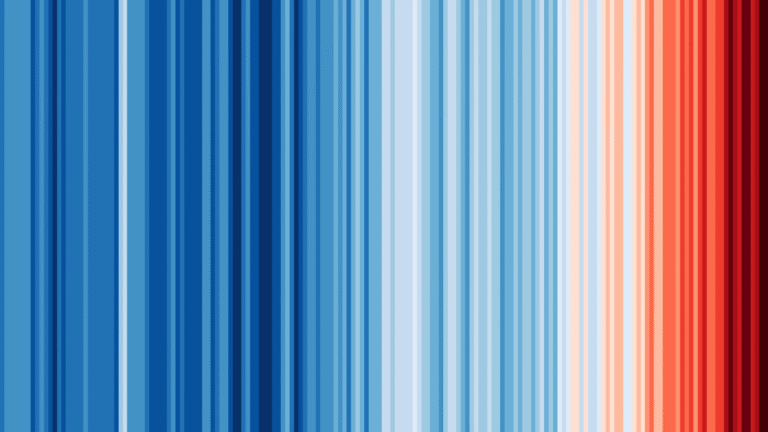

The government’s Autumn Budget 2024 has introduced targeted investments to accelerate progress toward net zero, with a focus on clean energy infrastructure, decarbonisation and transportation. Here’s an overview of the major measures introduced to help drive the government’s aim of making Britain a clean energy superpower.

Clean energy

Carbon Capture and Storage (CCS): The government has committed £3.9 billion to expand CCS projects, for capturing CO₂ emissions and reducing industrial carbon emissions.

Nuclear energy: An additional £2.7 billion is allocated to Sizewell C, a nuclear power plant aimed at providing a stable, long-term energy source. This reflects the UK’s strategy of including nuclear power in its clean energy mix for consistent, low-carbon electricity.

Hydrogen: The Budget also emphasises green hydrogen, supporting the development of production sites that will further decrease the UK’s reliance on fossil fuels.

Great British Energy (GBE): This new, publicly owned company will be based in Aberdeen, capitalising on Scotland’s established energy expertise. GBE is expected to lead in clean energy innovation, with partnerships boosting renewable energy projects nationwide.

Industrial and public sector decarbonisation

The Budget promises continued support for the Industrial Energy Transformation Fund (IETF) and the Public Sector Decarbonisation Scheme (PSDS), both of which aim to fund energy efficiency projects and support decarbonisation across public and private sectors.

Transportation

Fuel Duty and Vehicle Excise: The extension of the 5p cut in fuel duty for petrol and diesel for an additional year benefits drivers. However, there’s also a planned increase in Vehicle Excise Duty (VED) for high-emission vehicles, intended to encourage a shift toward electric vehicles (EVs).

Electric Vehicles (EVs): EVs remain attractive due to the continuation of low Benefit-in-Kind (BIK) tax rates. The budget also allocates funds to expand EV charging infrastructure, addressing one of the barriers to widespread EV adoption.

Air Passenger Duty: Effective in 2026, a hike in Air Passenger Duty (APD) will see a £2 increase for short-haul economy flights and £12 for long-haul flights, with private jet rates rising by 50%. This measure aims to curb carbon emissions from air travel.

Summary

Together, these investments and policies underscore the government’s commitment to transforming the UK into a “clean energy superpower.” By supporting green energy projects, incentivising low-emission transportation, and targeting industrial decarbonisation, the budget reflects an integrated approach to accelerating a greener future.