What is the Carbon Border Adjustment Mechanism?

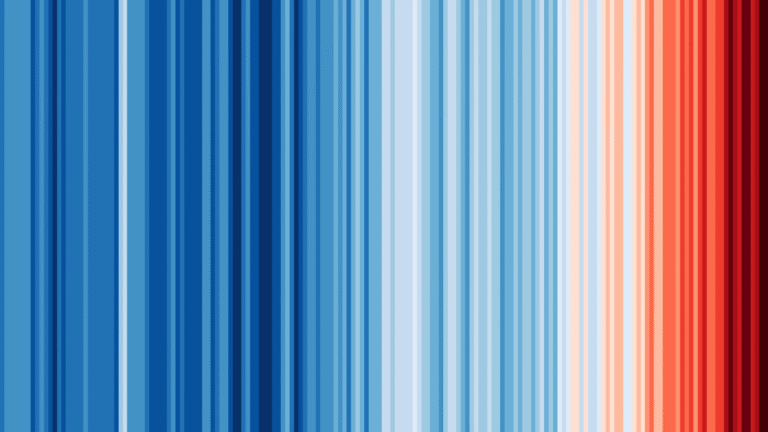

The EU’s Carbon Border Adjustment Mechanism (CBAM) introduces a tax on carbon-intensive imports to the EU by imposing a carbon price on imported goods. This is based on the carbon emissions associated with their production. The landmark initiative aims to ensure that the environmental costs of production are fairly accounted for, regardless of origin. It is hoped that it will encourage companies outside of the EU to adhere to the same environmental standards as EU-based manufacturers and to drive cleaner industrial production. CBAM also seeks to combat carbon leakage, where businesses relocate production to countries with less stringent emissions regulations, potentially undermining the EU’s climate goals.

CBAM ensures that the cost of carbon for imports mirrors that of EU domestic production, aligning with the EU’s commitment to reduce greenhouse gas emissions and aligning with World Trade Organization (WTO) rules, promoting fairness and encouraging global adoption of sustainable practices.

Who needs to comply?

On 1 October 2023, CBAM was introduced in a transitional phase focusing on emissions-intensive sectors – iron and steel, aluminium, cement, fertilisers, electricity and hydrogen. If you are a UK business exporting emissions-intensive goods to the EU in one of those sectors, you may be in scope of the EU CBAM.

During this phase, UK companies in scope will be required to provide detailed emissions data to their EU customers. This step will help their customers fulfil their CBAM reporting obligations and ensure the goods meet the required emissions standards.

From 2026, CBAM will require importers to purchase CBAM certificates reflecting the carbon intensity of their goods and the gap between the carbon price of the EU and that of the origin country.

Steps to compliance

To comply with CBAM, businesses must identify goods within scope, measure their embedded carbon emissions, and report these emissions quarterly. Starting in 2026, businesses must purchase CBAM certificates to account for emissions, based on the difference between the EU’s carbon price and that of the exporting country.

How we can help: Streamlining CBAM compliance

The complexities of the CBAM regulations can be daunting. Our expert team is well versed in carbon reporting and compliance requirements and can guide you through the process, from the initial mapping of relevant goods to the final submission of required data. We provide end-to-end support, including:

1. Process mapping: We help you identify which goods are subject to CBAM by analysing your product portfolio and ensuring the correct categorisation of each item.

2. Measurement of embedded emissions: For goods within scope, we calculate the embedded emissions using industry-standard methodologies. This will allow you to report your carbon footprint accurately.

3. Documentation and methodology: We support you in documenting the methodology behind your emissions calculations, ensuring compliance with EU requirements. This includes the creation of a monitoring methodology document (MMD), which is an essential part of the CBAM management handbook.

4. Ongoing monitoring and reporting: We offer continuous support in monitoring emissions and preparing reports, ensuring that you remain compliant throughout the transition phase and beyond.

Our team will also assist with the CBAM communication template, a vital tool for ensuring transparent and correct reporting to your EU customers.

Seizing the opportunity: A proactive commitment to lower-carbon processes

While reporting during this transitional phase may seem like a mere administrative task, it offers a significant opportunity for UK businesses to demonstrate a proactive commitment to sustainability. By reducing your carbon footprint and partnering with lower-carbon suppliers, you can not only comply with CBAM but also enhance your competitiveness in the EU market, where consumers and businesses are increasingly prioritising sustainability.

In the coming years, companies that invest in cleaner technologies, better data reporting, and partnerships with low-carbon suppliers will thrive. With the right guidance and tools, your business can seamlessly navigate this complex landscape and secure its place in the sustainable future of international trade.

At Zenergi, we’re here to help you make this transition with confidence. Talk to us to understand how we can guide you through the complexities of CBAM compliance.